ABOUT CORPORATE LAW BOARD:

The Corporate Law Board is an autonomous board of All India Legal Forum. It is an initiative to engage a discussion around corporate law and policy in India and across the globe. The Board adopts a cross jurisdictional and multi-disciplinary approach in analysing the various corporate law issues, regulatory framework and policy obligations. The Board aims to critically overlook the various corporate law enactments and the objectives that such

enactments propose.

PEOPLE BEHIND ALL INDIA LEGAL FORUM:

All India Legal Forum is a team of more than 800 law students across the country to tackle basic problems which a legal researcher faces in day to day life. We are pleased to have the support of a diverse group of eminent personalities, comprising: Justice Arjan Kumar Sikri, Justice Mukundakam Sharma, Justice Bellur Srikrishna, Justice S.L. Bhayana, Justice Amarnath Jindal, Dr.Vinod Surana, CEO and Partner, Surana and Surana International

Attorneys, Mr. Ajit Prakash Shah, Former Chairman, 20 th Law Commission of India, Mr. Rishabh Gupta, Partner, Shardul Amarchand and Mangal Das, Mr. M S Bharath, Senior Partner, Anand and Anand Associates, Mr. Safir Anand, Senior Partner, Anand and Anand Associates, Mr. JLN Murthy and many more as our honorary board members.

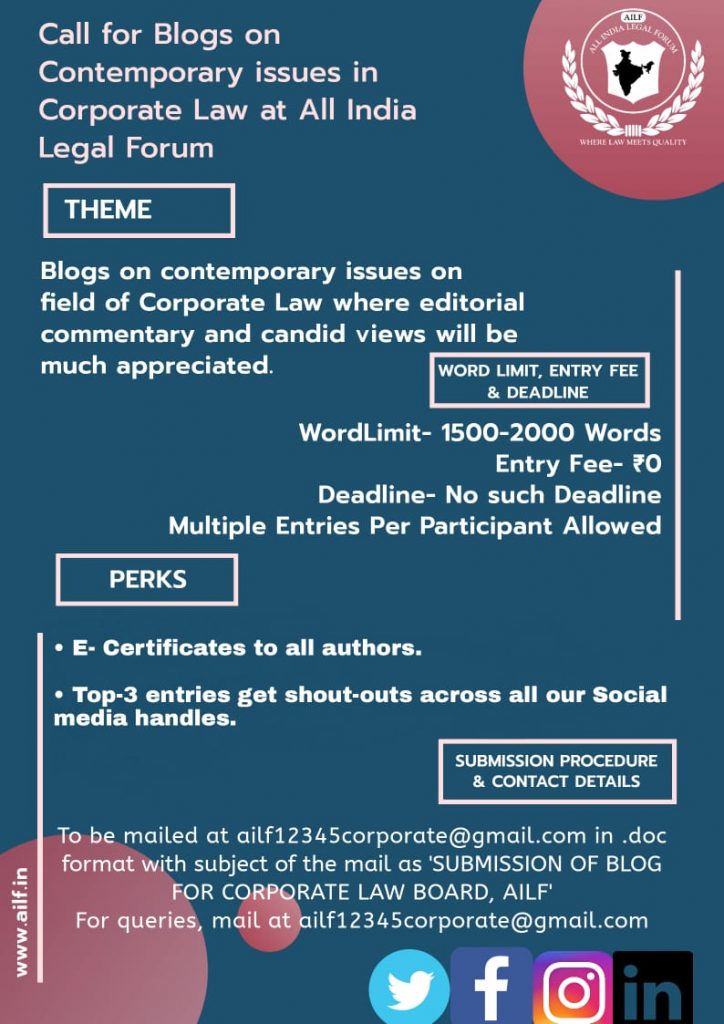

SUBMISSION GUIDELINES:

- The Corporate Law Board accepts submissions on a rolling basis on corporate law, securities law, insolvency law, banking law, commercial, competition law and taxation law etc.

- Submissions can be in the form of articles, opinions, case comments and short notes on the aforementioned topics.

- Submissions for the blog shall be reviewed on a rolling basis.

- Submissions must be original. By submitting an article, the author undertakes that it has not been submitted, accepted, or published elsewhere.

- Authors are advised to keep their articles concise and precise to enhance the effectiveness of their posts, ideally not more than 1500 words excluding footnotes.

- Authors are advised to make succinct, initial paragraphs to summarize the substance of their posts.

- The font size should be Times New Roman 12 for the body, TNR 14 for headings with 1.5 line spacing for the text in the body. The footnotes should be TNR 10 with single spacing.

- All relevant sources must be given proper referencing. The mode of citation to be followed is OSCOLA.

- Submissions must be in Word Format (.doc or .docx).

- The maximum number of co-authors permitted is two.

- Please ensure that the title of the submission is not more than eight words long.

- Authors must include their full name and institution/organization name in the separate cover letter and submit their Blog at (ailf12345corporate@gmail.com) with the subject line- ‘AILF Corporate law Blog Submission’.

- The Corporate Law Board solely reserves the right to accept or reject the submission after a due and rigorous editorial review.

- Any non-compliance with the above-mentioned guidelines shall result in a breach. Thus, leading to the rejection of the submission.

- The author will be communicated about the acceptance or the rejection of his/her submission within 2-3 weeks of submitting the blog via email.

- Non-adherence to the above-mentioned guidelines will lead to a direct rejection of the article.

- If submission of author is accepted, then it will be notified via email once we have uploaded it to our Blog website and certificate of publication will be issued to the author.

ENTRY FEE:

No entry fee will be charged. Submissions are free of cost on rolling basis. One person can submit as many articles as one wish and as frequently as one wishes to.

DEADLINE:

There is no deadline for submissions, however early submissions would be appreciated. We are currently accepting submissions on a rolling basis.

PERKS:

- An e-certificate would be awarded to the authors whose blogs are published along with blog link.

- Top 3 reads will get a shout-out from all our social media handles.

SUBMISSION PROCEDURE:

Submissions should be mailed to ailf12345corporate@gmail.com [cc to:

akaraayush@gmail.com] in .doc format, with the subject of the mail as “Submission of Blog for Corporate Law Board, AILF”. Kindly go through the submission guidelines before submitting your blog.

CONTACT DETAILS:

In case of any query, kindly mail to us at: ailf12345corporate@gmail.com